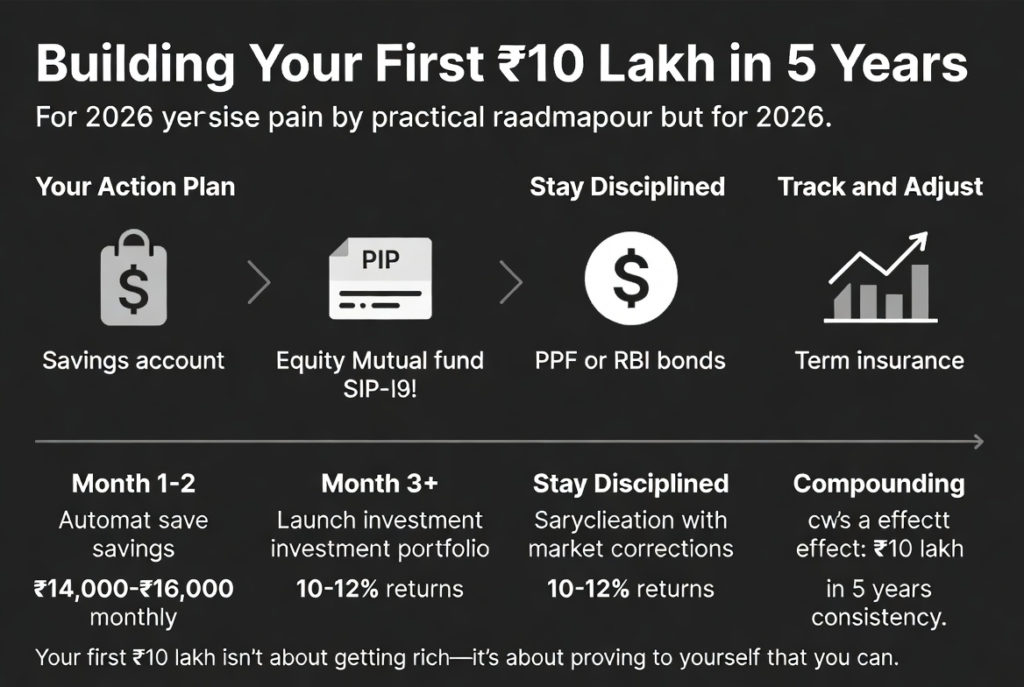

Your first ₹10 lakh is the hardest milestone—but it’s achievable with disciplined execution. Here’s a practical roadmap for 2026.

The Math Behind It

To reach ₹10 lakh in 5 years, you need to consistently save and invest ₹14,000–₹16,000 monthly at 10–12% annual returns. This assumes you’re earning ₹60,000+ monthly with a savings rate of 20–25%. If your income is lower, extend your timeline to 7 years—consistency matters more than speed.

Your Action Plan

Month 1–2: Automate savings. Set up a separate savings account and route 20% of salary there immediately after credit. Simultaneously, open an EPF/NPS account if you haven’t already.

Month 3+: Launch your investment portfolio: ₹8,000–₹10,000 into equity mutual fund SIPs (diversified mid-cap and large-cap), ₹3,000–₹5,000 into PPF or RBI bonds for stability, and ₹1,000–₹2,000 towards a term insurance premium.

Stay Disciplined

Your first ₹10 lakh tests your commitment. You’ll encounter market corrections, peer pressure to upgrade your lifestyle, and temptation to skip months. Don’t. The real wealth acceleration happens in years 3–5 when compounding kicks in. That ₹10 lakh can become ₹25+ lakh by year 10 if you stay invested.

Track and Adjust

Review your portfolio quarterly. If market volatility rattles you, you’re not diversified enough. If you’re not saving consistently, your budget needs reworking. Small course corrections now prevent derailment later.

Your first ₹10 lakh isn’t about getting rich—it’s about proving to yourself that you can. From there, everything accelerates.