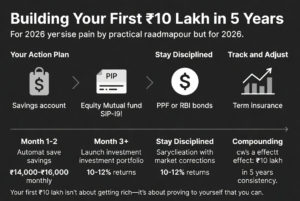

To reach ₹10 lakh in 5 years, you need to consistently save and invest ₹14,000–₹16,000 monthly at 10–12% annual returns. The real wealth acceleration happens in years 3–5 when compounding kicks in. That ₹10 lakh can become ₹25+ lakh by year 10 if you stay invested.

Your first ₹10 lakh isn’t about getting rich—it’s about proving to yourself that you can. From there, everything accelerates.